Welcome back for week 3 of 8! If you missed the prior week’s editions you can access them directly below by clicking the blue wording.

The 8 part series will cover the following:

Inventory Management

Expense Management

Leveraging Financial Options

Cash Flow Optimization

Cash-Savvy Culture

Proactive Approach

One area that can significantly impact cash flow, yet is often overlooked, is inventory management. Properly managing inventory not only helps in maintaining sufficient stock levels but also plays a critical role in ensuring that your cash flow remains healthy. In this edition of The Bottom Line, we’ll look into the connection between inventory management and cash flow, explore common challenges businesses face, and provide actionable strategies to help you and your team optimize your inventory for better financial health.

Understanding the Cash Flow-Inventory Connection

Inventory represents a substantial investment for most businesses. The process of purchasing, storing, and managing inventory ties up a significant portion of your cash, which could otherwise be used for other critical operations. While inventory is a vital component of meeting customer demand and driving sales, excessive or poorly managed inventory can create cash flow challenges.

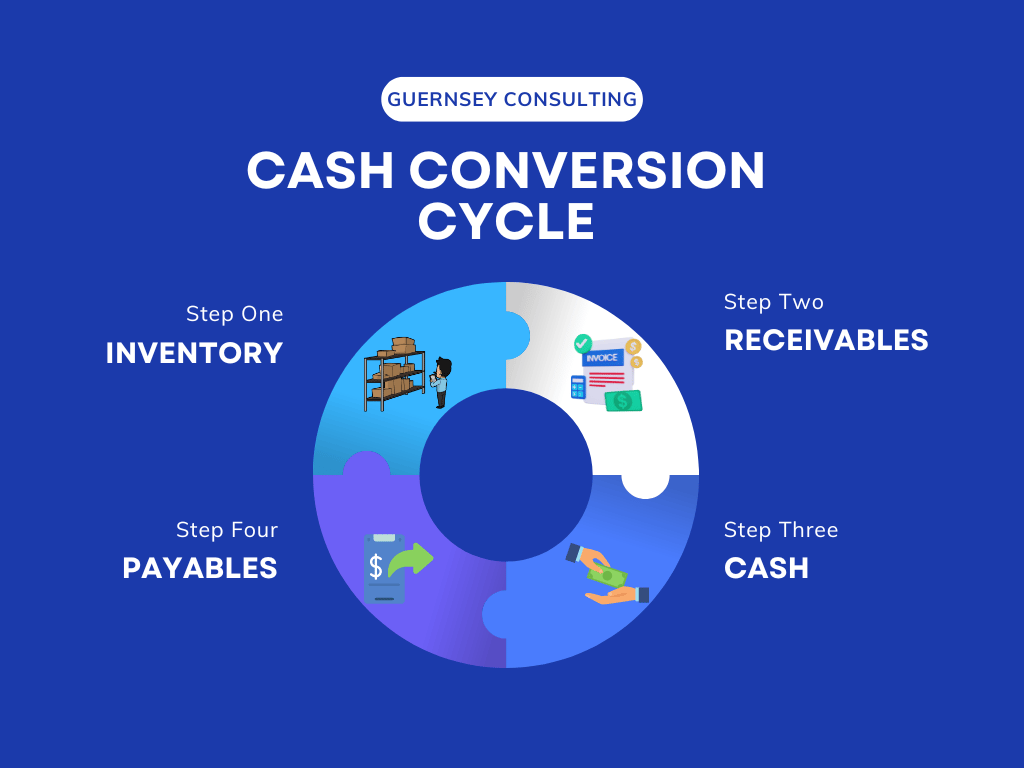

The cash conversion cycle, which starts when you purchase inventory and ends when you collect cash from sales, is directly affected by how long inventory sits on your shelves before being sold. This is known as the inventory turnover period. A high inventory turnover rate suggests that products are sold quickly, converting stock into cash more frequently, which positively impacts cash flow. Conversely, a low turnover rate indicates that products are moving slowly, resulting in cash being tied up in unsold goods, potentially leading to cash flow issues. Effective inventory management involves finding the right balance between having enough stock to meet customer demand without holding excess inventory that could strain your cash flow. How well do you feel you’re managing your inventory right now?

Key Points:

Inventory Turnover Rate: High turnover boosts cash flow; low turnover ties up cash in unsold goods.

Cash Flow Cycle: The length of the cycle is directly influenced by inventory management.

Balance: Aim for sufficient stock to meet demand without overstocking.

Common Inventory Management Challenges

Businesses face various challenges in managing inventory, each with its own implications for cash flow. One common issue is overstocking, which occurs when a business holds more inventory than necessary to meet customer demand. This can happen due to inaccurate demand forecasting, fear of stockouts, or promotional purchases that didn’t perform as expected. Overstocking ties up cash in unsold inventory, increases storage costs (including warehousing, insurance, and handling), and can lead to potential obsolescence or markdowns, further reducing profitability for your business.

On the other hand, stockouts occur when a business runs out of inventory to fulfill customer orders. While this may seem like a positive sign that products are selling well, it can have detrimental effects on cash flow. Stockouts can lead to missed sales opportunities, a damaged reputation, and increased costs due to expedited shipping or rush orders to replenish stock.

Inaccurate demand forecasting is another challenge that can lead to both overstocking and stockouts. When demand is overestimated, excess inventory is purchased, and when underestimated, businesses may face stock shortages. This leads to inefficient use of cash resources, higher costs associated with managing excess or insufficient inventory, and creates uncertainty, making it difficult to plan cash flow effectively. Ever walked into a business and need a common item they carry and they are out, go to the back to check, etc. and then you have to drive to other stores to get what you need? When this happens I think about forecasting their demand!

Supplier management issues can also create inventory management challenges. Poor supplier relationships or unreliable suppliers can lead to late deliveries, inconsistent quality, or unexpected price changes, which can disrupt inventory levels and cash flow. These challenges force businesses to carry extra inventory as a buffer, increase the likelihood of stockouts or overstocking, and complicate cash flow planning due to unpredictable costs. Keep close with your suppliers and make sure that relationship is solid.

Key Points:

Overstocking: Ties up cash, increases storage costs, and risks obsolescence.

Stockouts: Lead to missed sales, damaged reputation, and higher replenishment costs.

Inaccurate Forecasting: Causes both overstocking and stockouts, disrupting cash flow.

Supplier Issues: Lead to late deliveries, inconsistent quality, and the need for buffer inventory.

Your IRA, made to order

Choose where and when you want to retire, and a Betterment IRA can help make your money hustle all the way there.

Strategies for Effective Inventory Management and Cash Flow Optimization

To combat these challenges, implementing Just-in-Time (JIT) inventory management can be a highly effective strategy. JIT involves purchasing and receiving inventory only as it is needed for production or sales, minimizing the amount of inventory on hand, reducing carrying costs, and freeing up cash. This approach reduces excess inventory and associated costs, improves cash flow, and encourages better supplier relationships and more efficient operations. To implement JIT successfully, businesses should develop strong relationships with reliable suppliers, invest in technology to monitor inventory levels and automate ordering processes, and continuously analyze demand patterns to adjust JIT processes as needed.

Accurate demand forecasting is another key strategy. By predicting future sales with greater accuracy, you can reduce the risk of overstocking or stockouts, thereby stabilizing cash flow. Accurate demand forecasting ensures optimal inventory levels, improves cash flow by aligning inventory purchases with actual demand, and enhances customer satisfaction by meeting demand consistently. To achieve this, businesses should use historical sales data, market trends, and customer feedback to inform forecasts, regularly update forecasts to account for changes in the market or business environment, and consider implementing forecasting software that uses machine learning for more accurate predictions. This is something that is a constant ongoing part of the business!

Adopting an Inventory Management System (IMS) is another crucial step. An IMS is a software solution that helps businesses track inventory levels, orders, sales, and deliveries, providing real-time visibility into inventory and helping make informed decisions that positively impact cash flow. An IMS provides real-time data on inventory levels and movement, reduces the risk of human error in inventory tracking and management, and improves cash flow by optimizing inventory turnover and reducing carrying costs. Businesses should choose an IMS that integrates with their accounting and sales systems for seamless data flow, train staff to use the system effectively, and regularly review inventory reports to identify trends and make data-driven decisions.

There are all kinds of IMS options out there on the market that are tailored for different business models. Do your research and find the one that’s going to benefit your business.

Optimizing supplier relationships is also critical. Building strong relationships with suppliers can significantly impact inventory management and cash flow. By working closely with suppliers, you can negotiate better terms, improve delivery times, and reduce the risk of stockouts or overstocking. This enhances the reliability of inventory replenishment, reduces costs through better negotiation and volume discounts, and stabilizes cash flow by ensuring a steady supply of inventory without excess stock. To optimize supplier relationships, businesses should regularly communicate with suppliers to align on inventory needs and expectations, consider supplier diversification to reduce reliance on a single source, and negotiate payment terms that align with their cash flow needs, such as extended payment periods. I can’t tell you how strong relationships can help your business. Don’t burn bridges or cause strain on relationships and find a way to always keep those running like a well oiled machine!

Finally, monitoring and analyzing inventory metrics is essential for ongoing success in inventory management and cash flow optimization. Key metrics to track include the Inventory Turnover Ratio, which measures how often inventory is sold and replaced over a period; Days Inventory Outstanding (DIO), which calculates the average number of days it takes to sell inventory; Gross Margin Return on Investment (GMROI), which evaluates the profitability of inventory relative to its cost; and Carrying Costs, which track the total cost of holding inventory, including storage, insurance, and obsolescence. Regularly reviewing these metrics helps identify trends and make data-driven adjustments, improving inventory turnover and reducing carrying costs, ultimately leading to better cash flow management.

Key Points:

Just-in-Time (JIT): Minimizes excess inventory, reduces costs, and frees up cash.

Accurate Forecasting: Aligns inventory with demand, reducing the risk of overstocking and stockouts.

Inventory Management System (IMS): Provides real-time data, reduces human error, and optimizes turnover.

Supplier Relationships: Improve reliability, reduce costs, and stabilize cash flow.

Inventory Metrics: Track turnover, DIO, GMROI, and carrying costs to inform decisions.

Effective inventory management is a critical component of successful cash flow management. By understanding the connection between inventory and cash flow, addressing common challenges, and implementing strategies like JIT, accurate demand forecasting, and inventory management systems, you can optimize your inventory and maintain a healthy cash flow. Remember, the key to success lies in continuous improvement. Regularly review your inventory practices, stay informed about market trends, and be willing to adapt your strategies as needed. With the right approach, you can achieve a balance that supports both customer satisfaction and financial stability.

Do me a favor today - SHARE our newsletter by clicking the link below and letting your network know about our weekly discussions and our new online community the Cash Flow Chronicles. If these help you, they are going to help others too. Let’s get them this detail so they are informed like you!

As we move into the later half of August, I will be sharing some details that help with a few things in our premium Cash Flow Chronicles section. See below to make sure you are streamlining:

13 Week Cash Flow Reporting

Q3 Collections

Vendor Management

Bookkeeping Basics

I’ll be releasing specific details that I’ve used for 10+ years on these topics into the Cash Flow Chronicles Basic and Premium locations. Learn how to properly manage cash flow with your 13 week, how to maximize collections and get my help in doing this efficiently, how to negotiate stronger terms, and what I do for my own business bookkeeping that streamlines the closing process.

One on One consulting sessions.

Google Chat Q&A all week to help you with issues.

Weekly Overview and LIVE discussions on The Bottom Line topic.

File and Reporting development help.