Financial reports are only as useful as the work behind them.

If accounts are not reconciled monthly, the numbers you review are incomplete at best and misleading at worst. That’s when owners start questioning every report and relying on gut instinct instead. I’ve wrote a couple times about reconciling this week, mainly to our newer subscribers. But sending this to all of you as I want you to succeed this year and be thinking about things like this.

Reconciliations create control

They confirm cash balances are real

They ensure payments and expenses are recorded once and correctly

They catch issues before they distort decisions

What unreconciled books cause

Cash flow that never quite makes sense

Confusion around what is paid vs still owed

Time wasted chasing issues that should have been obvious

Monthly keeps problems small

Waiting until quarter-end or year-end allows errors to stack up. Monthly reconciliations keep the gap between reality and reporting tight and manageable. Some of you wait and do this at year-end. That’s mind boggling to me and is not something I recommend you do this year.

Clarity supports better leadership

When numbers are reliable, decisions move faster. You spend less time questioning reports and more time acting on them. Plus if you have plans for expanding into a new product line, developing an app, shipping more to your big customers, etc. you need to know where things are at, at all times.

January is the right moment to reset this habit. Clean, reconciled accounts make every other financial conversation easier.

If reconciliations are behind or inconsistent, reply to this email, message me in the community, or email [email protected]. Getting control starts with clean numbers.

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

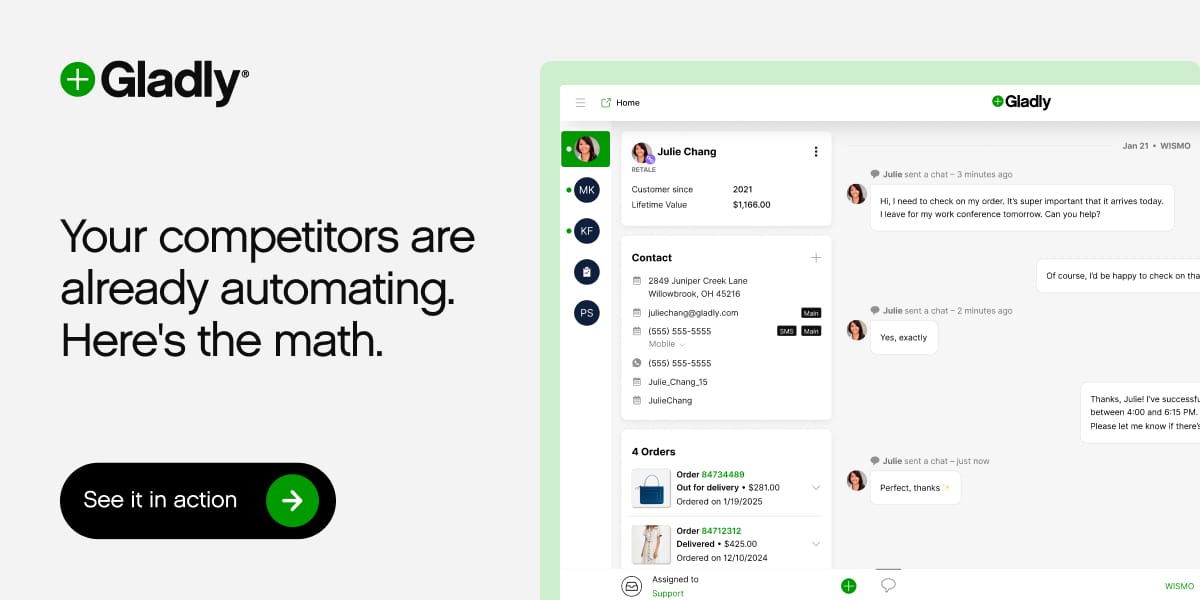

Sponsoring the Cash Flow Chronicles today is GLADLY AI!

Thank you for supporting our newsletter. Each time a reader engages with our sponsor’s ad, this directly supports CFC’s mission to be the TOP FINANCIAL newsletter Beehiiv has to offer.

Even if you do not buy a product, subscribe, etc. this greatly supports our mission. Take 5 seconds today and check them out!

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

Veteran business owner? Take command of your cash flow and tighten your financial systems. Join The Profit Platoon — a community built for Veterans.